OpEx vs CapEx

As businesses strive to become increasingly sustainable and energy efficient, one of the most important investments they can make is in lighting projects. Lighting accounts for a significant portion of a company’s energy consumption, so any effort to reduce these costs will have a direct impact on the financial bottom line of the business.

Investing in energy-efficient and sustainable lighting solutions provides long-term savings, but it requires careful consideration when deciding whether to invest through OpEx or CapEx. While both approaches have advantages and disadvantages, understanding how they work and their impact on sustainability and energy efficiency can help companies make the right decision for their situation.

OpEx (Operating Expenditure) involves paying a fixed amount for services such as installation, maintenance, repair, etc., while CapEx (Capital Expenditure) requires a large upfront investment in equipment such as lighting, fixtures and their installation. Both options have implications for short- and long-term sustainability goals and financial business situation – but which one is the best?

What is OpEx?

Operating expenditure (OpEx) is the cost required to run a business on a day-to-day basis, such as subscriptions, maintenance costs or office equipment. Employee wages are also included in the OpEx category.

Operating outlays are short-term expenses and are usually used up in the fiscal year in which they are purchased. OpEx purchases are paid weekly, monthly or annually and are deducted from a company’s budget when incurred.

OpEx expenses are tax deductible in the tax year in which they are incurred.

What is CapEx?

Capital expenditure (CapEx) consists of spending to acquire or upgrade physical assets such as buildings, land, vehicles, equipment and other items. CapEx is the money used to purchase long-term investments, such as upgrades to IT infrastructure or new production lines.

CapEx are not tax deductible in the same year they are incurred – instead, they must be depreciated over the period of their useful life. CapEx expenses are usually purchased on credit or through a loan and require a large upfront investment.

OpEx and CapEx in (re)lighting projects

So with lighting projects, you have the choice of an OpEx or CapEx approach; here at Project Nekton, we distinguish Light as a Service (LaaS) and Light at Your Service (LayS).

Light as a Service of LaaS

With Light as a Service (LaaS), we offer an OpEx model that does not require any prior major expenditure or capital investment. Here, the customer receives a turnkey service: from design and financing to installation and maintenance.

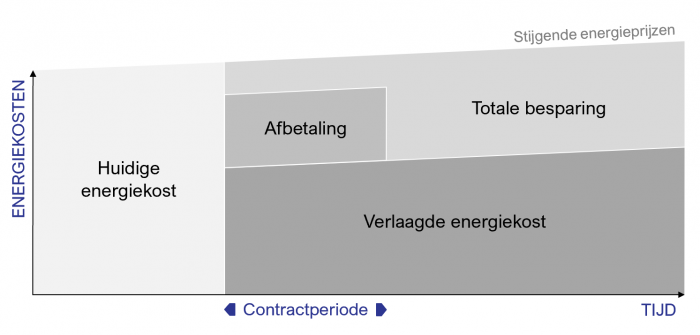

A flexible service term allows you to choose the solution that best fits your company’s budget and energy efficiency and sustainability requirements. Moreover, you can benefit from lower costs for energy consumption without having to invest a large amount upfront; the financing associated with energy savings is lower than your current operational costs.

Light at your Service of LayS (CapEx)

In addition to the LaaS model, we also offer a traditional CapEx procurement model. We call this model Light at your Service or LayS.

We still provide a 100% outsourced turnkey service, but as a customer you invest with your own capital for the system and then enjoy the guaranteed ROI of the new system.

Based on diagnostics, you manage installation and have visibility over actual savings. Something goes wrong? Then our team is intervening before you know it. We take the worries away from the customer and assume full responsibility for a continuously perfectly functioning installation.

What is the best choice in lighting projects?

In lighting projects, both OpEx and CapEx have advantages and disadvantages.

For companies that want to avoid significant upfront investments, the LaaS model offers a financially interesting and efficient solution. Customers can allocate capital to their core business instead of infrastructure upgrades, and have the choice of a flexible service term according to their own needs, fianancial situation and business goals.

This makes it easier to manage cash flow, but also limits potential long-term savings.

A traditional CapEx approach may offer better control over the project timeline and budget, but requires higher initial capital expenditures. In the long run, greater savings are possible with accelerated ROI, by leveraging our buying power, independent market knowledge and rapid assembly.

In general, CapEx ROI takes longer to realize than OpEx.

The best option for each project depends on a range of factors, including available capital, schedule, goals and desired/expected ROI.

A trusted partner like Project Nekton helps explore both OpEx and CapEx models in the most efficient and effective way for your business situation. Whichever solution you choose, we take away all concerns and fully assume the responsibility of a continuously perfectly functioning system!